Historic Preservation and Easements

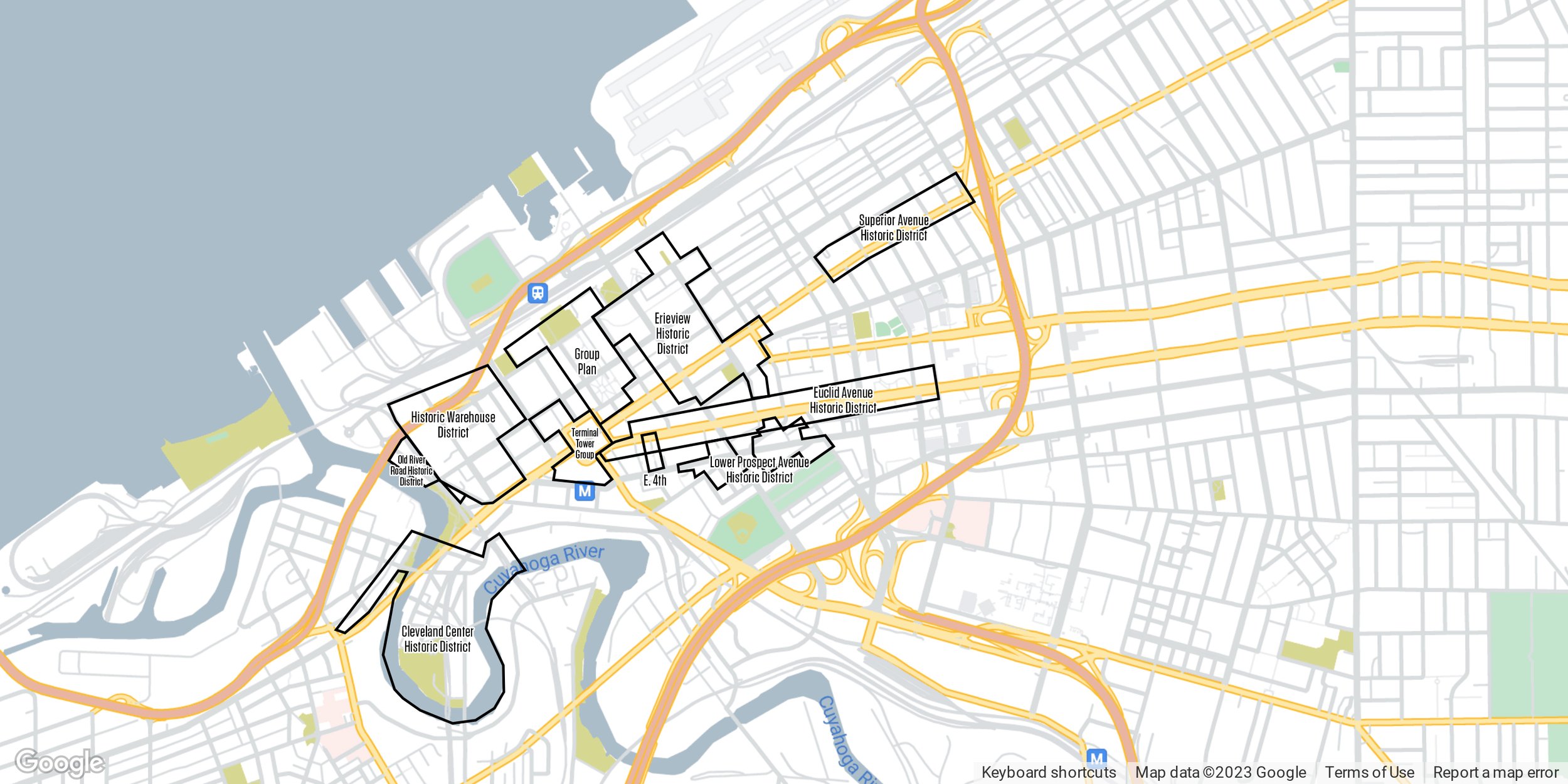

Downtown Cleveland is a national leader in historic building reuse and preservation. Downtown Cleveland, Inc. has advocated for the creation of our ten nationally designated historic districts in downtown Cleveland. The two key programs for adaptive reuse are historic tax credits and historic easements which can be layered with other development tools.

Let us connect you to helpful tools to preserve and update our historical city center.

Historic Tax Credits

Administered by the State of Ohio, The Ohio Historic Preservation Tax Credit Program provides a tax credit to leverage the private redevelopment of historic buildings. The program is highly competitive and receives applications bi-annually in March and September. The process has several benchmark deadlines, and the general first deadlines are January 31st and August 1st of each year (subject to change). More information can be found at the Ohio Department of Development’s website below:

The Historic Conservation Easement Program is a useful historic preservation development tool that both preserves historic structures and provides important equity to development projects that include historic structures.

Below are some frequently asked questions about Historic Conservation Easements. For more information, contact us below.

Historic Preservation and Easements FAQ

-

An owner donates to the recipient organization the right to prevent all present and future owners from making changes to a historic property, which would destroy its historic character. Otherwise, the owner retains all rights of ownership. The donated easement is attached to the deed and recorded at the county courthouse.

-

An easement can be taken for any property – commercial, industrial buildings, or open space. An easement can be donated before, during or after rehabilitation though the timing of an easement can have substantial tax consequences. In order to receive a tax deduction, the property must be listed on the National Register of Historic Places, be in a certified local historic district or be eligible for the National Register.

-

The property will be protected.

The value of the easement can be used as a charitable contribution.

Real estate tax is lower.

Documentation and photos of the property are recorded at the recipient organization.

-

The owner decides. Generally, an easement prevents owners and future owners from demolishing the structure or from altering the exterior of the building without consulting the recipient organization. Easements can also protect significant interiors or open spaces.

-

The owner gives up the right to make changes to the property without consulting the recipient organization. However, the owner continues to use and control the property.

-

Not necessarily, but some owners include provisions to allow the public an opportunity to appreciate their historic building, which in turn increases the value of the easement.

-

The recipient organization – Historic Gateway Neighborhood Corporation or Historic Warehouse District Organization is eligible to receive an easement donation.

-

The value of the easement, the deductible amount is roughly 10-15% of the value of the property as a tax deduction. However, this value may increase depending upon the level of restrictions and whether the interior of the building is included in the easement. Lost development potential can dramatically increase the value of easement, however, takes substantial due diligence to demonstrate.

Exterior or interior easements can allow change of use and configuration changes as long as they are in accord with the Secretary of Interior Standards for historic preservation.

An appraiser who is hired by the owner sets the easement value.

-

The owner pays three (3) fees:

To the recipient organization, a one-time processing cost of $c (est.) for consultation, photos and legal work.

To the recipient organization, a yearly monitoring cost. This covers an annual review of each property and staff time to respond to the owner’s questions. Contact us for a fee schedule.

An endowment and support fee. This amount is used to carry the program operation into perpetuity for legal defense, ongoing design reviews for all proposed future work and changes to the building, additional monitoring that may be required to defend and protect the easement, additional reserve (endowment) for escalating yearly required monitoring costs (staff time/photo documentation/record keeping, etc.) A yearly review must occur ongoing forever to sustain the legal integrity of the program. In addition, these funds are used to support, encourage and sustain the easement program.

The appraiser charges the owner separately.

Architectural/Historic Preservation Technical Services for Lost Development Potential Analysis – where lost development potential is possible this can have a dramatic impact on the value of the easement. This cost the owner pays separately.